Co-culturing cells

GFI grantee Dr. Mariana Petronela Hanga is researching culturing different cell types at the same time.

GFI grantee Dr. Mariana Petronela Hanga is researching culturing different cell types at the same time.

GFI grantee Dr. Girish Ganjyal at Washington State University is texturizing proteins and fiber to make better plant-based meat.

Learn about Dr. Dil Thavarajah’s work at Clemson University to breed organic pulse and cereal crops for improved protein biofortification.

Learn how GFI grantee Dr. David Julian McClements is developing an alternative to extrusion for producing plant-based meat at the University of Massachusetts.

Learn about Dr. Filiz Koksel’s work at the University of Manitoba to integrate sensors into plant-based meat extrusion.

Learn about Dr. Jian Li’s work at Beijing Technology and Business University to identify off flavors in pea protein and improve plant-based meat.

Learn about Dr. Marianne Ellis’s work at University of Bath to reduce the cost of bioreactors for cultivated meat production.

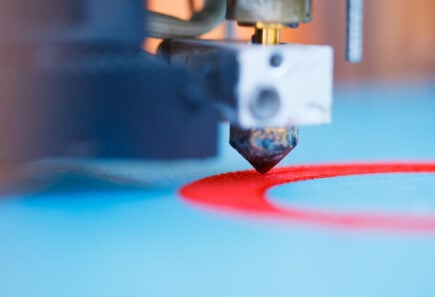

Learn about GFI grantee Dr. Sara Oliveira’s work 3D bioprinting scaffolds for cultivated meat the International Iberian Nanotechnology Laboratory in Portugal.

Learn about GFI research grantee BZ Goldberg’s work at The Mediterranean Food Lab to develop better flavors for plant-based meat using fermentation.

Learn about Dr. Ciara McDonnell’s work to establish high-pressure processing and high-pressure thermal processing parameters for plant proteins.