Investing in alternative protein

Explore opportunities to invest in alternative proteins and help fund the future of food. Our resources can help you identify relevant fundraising startups, understand the market and technical landscape, and inform your current portfolio companies.

Investor directory

Get inbound deal flow from alternative protein companies.

Invest in a good food future

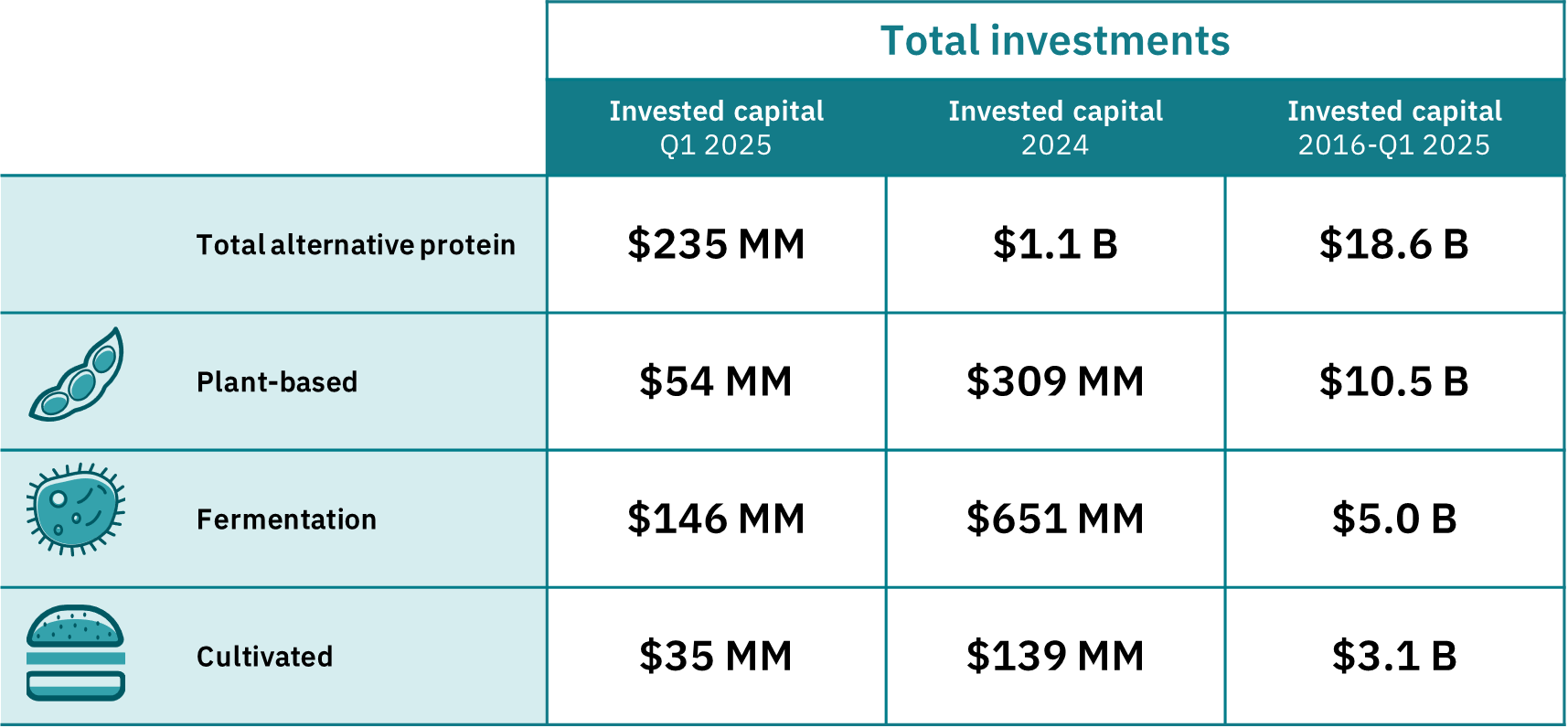

Investments in alternative proteins pass $18 billion

- The alternative protein industry raised $1.1 billion in investments in 2024, bringing total investments since 2016 to $18.6 billion.

- Alternative protein companies raised $235 million in Q1 2025, bringing total investments since 2016 to $18.6 billion. Plant-based companies raised $54 million in Q1, fermentation companies raised $146 million, and cultivated meat and seafood companies raised $35 million. All Q1 investments were raised by privately held companies.

- The investment environment of the past two years has been fundamentally different from the low-interest-rate period before 2022, when many of the largest rounds in privately held alternative protein companies were raised.

- Investments in fermentation companies showed resilience in an otherwise subdued funding environment, as the fermentation sector attracted over half of all total alternative proteins funding in 2024 and maintained that momentum into early 2025.

Significantly more investment is needed from both the public and the private sector to mitigate the environmental and public health impacts of food production and sustainably feed a growing global population.

Register with our investor directory (accredited investors only) to be contacted by startups raising funds, use the company database to discover new startups on the scene, see who is currently fundraising, and dive into our numerous other resources to understand the market and technical landscape.

Connect with alternative protein companies

Explore our resources, tools, and community-building opportunities for investors to learn how you can identify and approach alternative protein companies and funds.

Joining our investor directory allows accredited investors to express their interest in investing in alternative protein companies and funds by sharing key information about their mandates and areas of interest. GFI shares the directory with interested companies or funds, who then reach out to prospective investors who they believe are a good fit for their fundraiser.

Investor directory FAQs

Who has access to the investor directory?

Due to the sensitive nature of investor contact information and the conditions on which sharing consent was given, GFI maintains separate investor directories for companies and funds and limits directory access to alternative protein companies or funds who are currently fundraising or have successfully closed a funding round. Accredited investors can opt in to one or both directories below.

Alternative protein companies can request access to the investor directory by filling out this form. Alternative protein funds can request access by filling out this form. All requests will be reviewed by GFI and access to each respective directory will be granted to qualifying alternative protein companies or funds.

How do companies and funds contact investors through this list?

Investors opt in to sharing their email addresses, which companies and funds can use to contact investors.

The use of information from the directory for marketing purposes or mass emailing is not permitted. If you believe someone is violating this rule, please email corporate@gfi.org and GFI will take appropriate action.

What is GFI’s policy on making introductions between companies and investors?

In order to ensure that GFI is providing equitable support to all alternative protein companies and investors, we do not make direct introductions between companies and individual investors. Instead, we provide companies raising funds with access to the investor directory and encourage them to reach out to investors directly or seek an introduction from outside GFI.

How can I edit my information or remove myself from this list?

Investors can edit their information or remove themselves from the investor directory by emailing corporate@gfi.org.

Company database

Our company database lists alternative protein companies along with their attributes, such as product and technology focus, operating regions, date founded, and founders.

Fundraising database

Our fundraising database lists alternative protein companies currently engaged in a fundraising round (as self-reported by companies) and round characteristics, including asset type, round type, target deal size, and target investor type.

Funding by Beyond Animal

Beyond Animal is a Swiss company accelerating the growth of the vegan economy. Their digital platform, Funding by Beyond Animal, matches investors with animal-free businesses and facilitates the funding process. Investor members can use the platform to invest in companies providing sustainable, animal-free products and services. The Funding by Beyond Animal deal room offers a searchable pipeline of deals, full investor information packs, and a transaction process.

Accessing the opportunity as a non-accredited investor

We are often asked by non-accredited investors how they can invest in alternative proteins. While options are unfortunately limited as in the United States individuals and entities who do not meet the accredited investor criteria under SEC Regulation D are generally unable to participate in private company fundraising rounds, there are some options available. Investors may:

- Participate in equity crowdfunding or support product crowd-funding campaigns. The passage of the Jumpstart Our Business Startups (JOBS) Act allowed non-accredited individuals to take part in crowdfunding up to individual limits based on net worth and income. Select private alternative protein companies have raised early-stage capital through crowdfunding platforms.

- Invest in startups through public holding companies. There are several publicly listed holding companies that provide look-through access to private alternative protein startups, including Agronomics Limited, Eat Beyond, and Eat Well Investment Group Inc.

- Invest in publicly traded companies. While still limited in number, there are some publicly traded alternative protein companies, indexes, and ETFs investing in alternative protein companies, listed on major stock exchanges, such as Beyond Meat (NAS: BYND), Oatly (NAS: OTLY), Steakholder Foods (NAS: STKH), and Moolec Science (NAS: MLEC); The Vegan World Index®; the U.S. Vegan Climate ETF (VEGN), and the VanEck Future of Food ETF (NYSE: YUMY). In addition, select alternative protein companies are listed on regional exchanges, including including AAK (STO: AAK), Burcon NutraScience Corporation (TSX: BU, OTCQB: BRCNF), DUG Foodtech (STO: DUG), NextFerm (TLV: NXFR), Planet Based Foods Global (CSE: PBF, OTCQB: PBFFF, FRA: AZ0), Sensible Hot Dogs (NEO: HOTD, FRA: OX4), SavorEat (TAE: SVRT), and Else Nutrition Holdings (TSX: BABY).

- Incorporate considerations of alternative proteins in broad public equity portfolios. Within their public equity portfolios, investors can overweight food and meat companies that are more engaged in alternative proteins and underweight those less engaged. The Coller FAIRR Protein Producer Index and Sustainable Proteins Hub may be helpful tools in such assessments. Investors may also utilize proxy voting and/or activist investment strategies to encourage a focus on alternative proteins, sustainability in companies’ supply chains, and sustainability-related targets and disclosures.

Disclaimer: The Good Food Institute is a 501(c)(3) nonprofit organization and is not a registered investment, legal or tax advisor or broker/dealer. All opinions expressed and content provided here are for informational purposes only. GFI makes no representations whatsoever regarding, and does not endorse, any companies or funds listed above, which are provided solely for illustrative purposes and are subject to change based on market performance, financial stability, and regulatory actions. Please seek advice from a licensed professional and independently verify any information provided prior to investing.

Sign up for our investor newsletter

GFI’s quarterly newsletter provides investors with timely industry insights, new investment data and analysis, research, and tools to aid their exploration and due diligence of the alternative protein industry. This is your go-to source for investment data and news.

Check out previous investor newsletter editions

Understand the market

Gain a deeper understanding of the alternative protein market with our open-access reports and resources.

State of the Industry Reports

Our State of the Industry Reports are the most comprehensive analyses of alternative proteins to date. Each year, we publish reports covering the plant-based, cultivated, and fermentation-enabled protein sectors.

These reports outline the exciting developments happening across the alternative protein landscape. Topics covered include the commercial and company landscape, key regulatory updates, scientific innovations, product launches, and sales data. The reports also provide an in-depth analysis of the investment landscape using custom datasets curated by the Good Food Institute.

Plant-based sales data

GFI’s analysis of SPINS retail sales data covers the size and growth of the plant-based market in U.S. retail by category and provides side-by-side comparisons with animal product sales.

GFI Europe’s analysis of Nielsen IQ data showcases the growth of the plant-based sector in Europe.

Our annual foodservice sales data analysis of Circana data features broadline distributor sales data and consumer insights for plant-based protein in foodservice.

The global market

Our international market reports and resources showcase the landscape for global investment opportunities in alternative proteins:

- Asian Cropportunities: Supplying raw materials for plant-based meat

- Israel State of the Industry report

- India State of the Industry Report

- APAC State of the Industry Report

- Germany State of the Industry Report

Subscribe to The Alternative Protein Opportunity monthly newsletter to access new GFI global reports as they are published.

Engage with GFI

Our no-cost engagements with investors provide education on the alternative protein industry, including global and regional market data, consumer insights, sales and investment trends, technological updates, and regulatory information. As examples, these engagements can take the form of GFI:

- Presenting on the financial and impact opportunities in alternative proteins to institutional investors considering investing in the industry for the first time or deepening their investment.

- Helping craft an agenda and source speakers for an alternative protein “investor day” or client webinar.

- Presenting to a bank’s wealth management division to educate advisors and/or their clients on the investment opportunities within the alternative protein industry.

- Consulting with sell-side analysts on how best to incorporate alternative protein in their research coverage.

Please note that we cannot review materials from individual companies as part of this service. Rather, we provide context for the industry as a whole that can complement your own due diligence efforts.

To schedule one of these sessions, please email corporate@gfi.org.

White space opportunities

The alternative protein industry is young and rapidly growing. GFI’s research will help you understand the market white spaces so you can recognize and capitalize on opportunities.

- Innovation priorities: Explore the most high-impact areas where innovation is needed to create alternative proteins that are as affordable and delicious as conventional animal products. This list of innovation priorities is synthesized from surveys with over 180 alternative protein stakeholders, from researchers to entrepreneurs.

- Solutions Database: Use the database to discover ideas for new commercial ventures and products and discover the most high-impact opportunities to fund. GFI’s solutions database is routinely updated with solutions with the potential to accelerate the growth of the alternative protein industry.

Understand the technical landscape

The following resources will help you understand the technical aspects of alternative protein production so you can better evaluate the risks and opportunities associated with investing in alt protein companies.

- Free online course on the science of alternative proteins: This six-session self-paced course covers the biological and chemical processes used to produce plant-based, cultivated, and fermentation-derived proteins, the environmental and economic drivers behind these market sectors, and the dietary roles of proteins.

- GFI has published several technical papers and open-access resources on topics including formulating with animal-free ingredients, a life cycle assessment (LCA) and techno-economic assessment (TEA) for cultivated meat, and plant-based manufacturing.

- Learn more about the science of making meat with plants, animal cell cultures, and microbes.

Technical due diligence

Technical due diligence is important for investment in any food manufacturing business. The following resources will support you in conducting your own due diligence.

- Sample technical questions for cultivated meat due diligence: Use these questions to pressure-test the technical strategy of cultivated meat companies. This list is meant to provide a starting point for technical due diligence. It can and should be modified to fit a given company.

- Industry consultants: Identify consultants specializing in one or more segments within the alternative protein industry including plant-based, fermentation-derived, and cultivated meats.

Technical workshops

Our Science & Technology team offers no-cost educational sessions to investors seeking to better understand the science of alternative proteins. We cannot comment on specific companies’ technology or review materials from individual companies as part of this service. Rather, we provide context for the industry as a whole to complement your due diligence efforts.

Note: Due to the large number of requests we receive for these technical education sessions, we offer this service on a case-by-case basis for investors who meet at least one of the following criteria:

- Investors who routinely lead deals at Series A or beyond.

- Investors who typically join the capitalization table at Series B or beyond.

To request a session, please email corporate@gfi.org.

Join our Investor Directory

Are you an accredited investor interested in funding high-impact alternative protein startups or funds?

GFI maintains investor directories that we share with companies or funds that meet certain criteria. GFI only shares these directories with alternative protein companies or funds currently fundraising, and the directories live in password-protected Airtable bases. Once you are added to the applicable directory, interested companies or funds can contact you directly. The GFI investor directory is a list of investors who have expressed interest in plant-based foods, fermentation-enabled products, cultivated meat, and other innovative alternatives to animal products.

Note that you must be an accredited investor under SEC Regulation D to be added to this list. Also note that GFI provides these directories to companies or funds solely on the basis of their self-reported focus on alternative proteins and fundraising status; GFI makes no representations or warranties as to the merits or likelihood of commercial success of any company or fund that may contact investors via this directory. Any investment is made at the investor’s own risk.

Read our FAQs about the GFI investor directory. If you have additional questions, please reach out to corporate@gfi.org.

Resources for investors

Find innovation opportunities

We’ve worked to identify specific commercial white spaces that offer clear business opportunities for investors in the industry. View our full Solutions Database for further ideas.

-

Cultivated

-

Fermentation

-

Plant-Based

Synergistic climate and biodiversity benefits of alternative proteins

The direct climate and biodiversity benefits of alternative proteins are well understood by the alternative protein community, but the synergistic benefits of alternative proteins with other solutions—for example, clean energy…

-

Cultivated

-

Fermentation

Cultivated, fermentation-derived, or hybrid surimi

There has been little publicly announced R&D and commercial effort to develop cultivated, fermentation-derived, or hybrid surimi. Compared to other meat products, surimi is likely to be by far one…

-

Cultivated

-

Fermentation

-

Plant-Based

Hybrid products to optimize nutrition, taste, cost, and sustainability

Hybrid products are a promising means to introduce cost-competitive versions of cultivated meat to the market while improving the taste of plant proteins. Promoting the health benefits of hybrids may…

Resource

Funding the build

A review of the funding landscape for alternative protein scale-up and commercial manufacturing.

Page

Environmental, Social, and Governance framework

GFI & FAIRR’s ESG frameworks supply investors and companies in the alternative proteins industry with tools to monitor, measure, and report on risks and opportunities.

Invest in the entire industry with a donation to GFI

In addition to investing in individual startups, a donation to GFI will maximize your impact for the entire alternative protein industry. Receiving 100 percent of our funding through philanthropy allows us to keep resources and advisory services free and open-access.

GFI engages with all stakeholders across the value chain — from investors and startups to established manufacturers, retailers, and foodservice companies. This allows us to accelerate the entire alternative protein industry.