Nine top takeaways from record-setting year for alt protein sales, investments, and company launches

Transformation. Potential. Momentum. These are some of the words frequently used to describe the opportunity of alternative proteins. And in 2020, alternative proteins gained even more traction as records were set in global sales, investments, and new company launches.

GFI’s freshly launched 2020 State of the Industry reports analyze the commercial landscape, investments, scientific and technological developments, and regulatory and government activity across plant-based, cultivated, and fermentation-enabled platforms. They demonstrate that alternative proteins have clear potential to transform the trillion-dollar meat market, and show why now is the perfect time for companies and governments to invest.

Download GFI’s 2020 State of the Industry reports:

From industry growth, to regulatory milestones, to market debuts, here are our top nine insights from the reports:

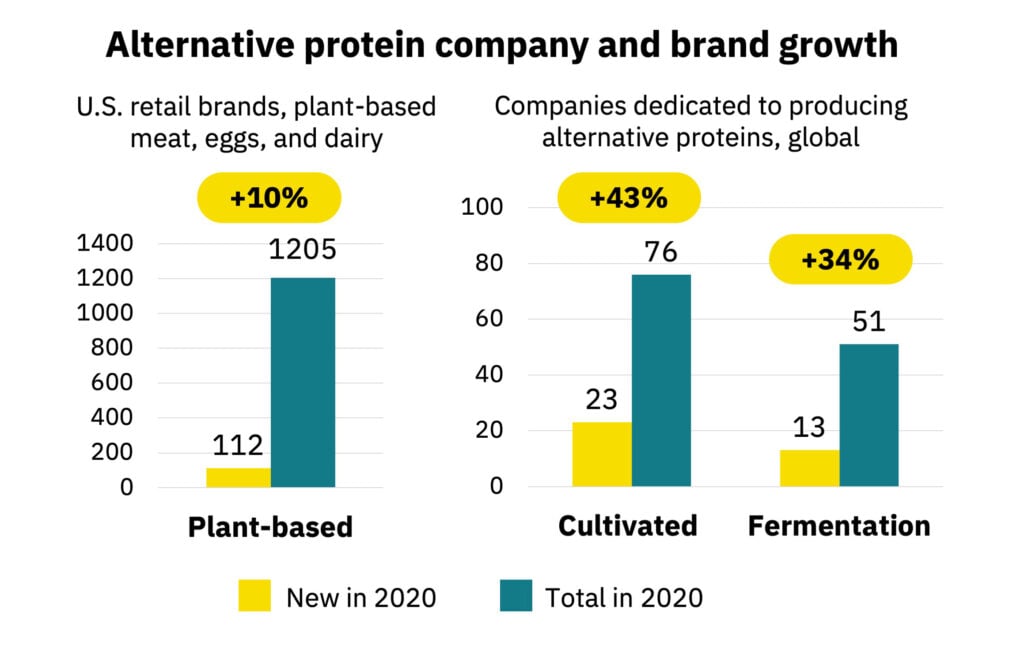

1. The number of alternative protein companies around the globe is growing rapidly.

In 2020, dozens of new alternative protein companies launched across all three sectors.

- Cultivated:

- 23 new companies launched by the end of 2020 (an all-time high), for a total of 76 companies dedicated to developing cultivated meat (a 43 percent increase from 2019).

- At least 40 additional companies (largely life sciences companies) have business lines in cultivated meat.

- Plant-based:

- At least 112 plant-based meat, egg, or dairy brands launched in U.S. retail, a 10 percent increase from 2019, for 1,205 total brands sold in 2020.

- Fermentation:

- 13 new companies launched for a total of 51 companies dedicated to fermentation-enabled alternative proteins (a 34 percent increase from 2019).

- More than 30 additional companies have business lines in fermentation for alternative proteins.

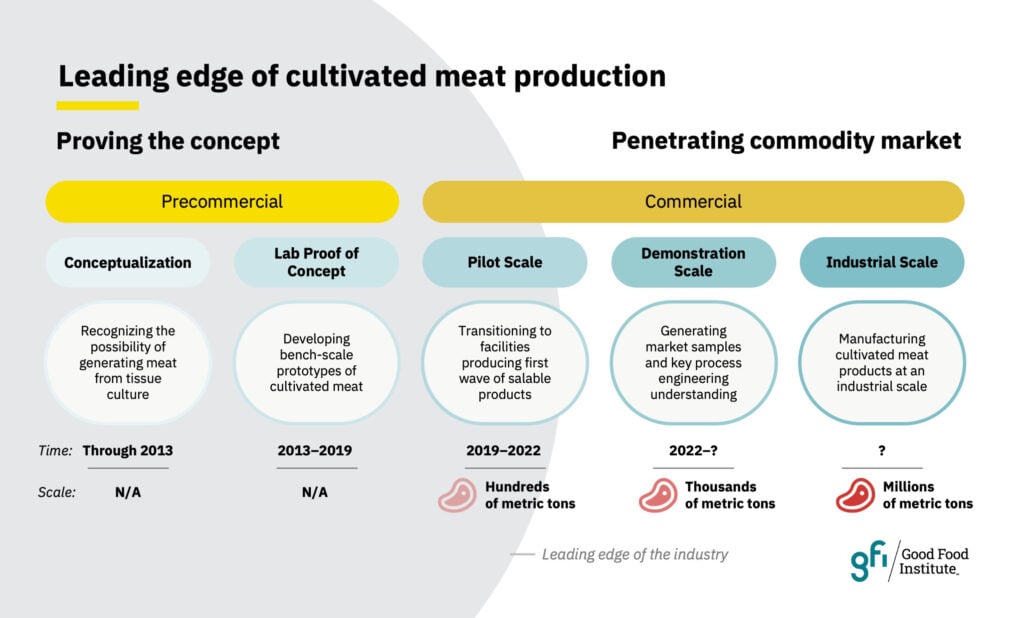

2. Cultivated meat arrived in the marketplace.

Singapore became the first country to approve the sale of cultivated meat.

- The launch of Eat Just’s GOOD chicken in Singapore restaurant 1880 marked the first time cultivated meat was commercially available.

- As of Earth Day, cultivated meat is available for home delivery in Singapore in a partnership between Eat Just and foodpanda.

- Investment in cultivated meat companies topped $350 million in 2020, nearly six times more than in 2019, and nearly double the previous cumulative investment in the industry. 2020 also saw the industry’s first Series B funding rounds.

3. Israel’s Benjamin Netanyahu became the first head of government to eat cultivated meat.

GFI Israel and Aleph Farms hosted Israeli prime minister Benjamin Netanyahu for a tasting of Aleph Farms’ cultivated steak.

- In an encouraging step toward cultivated meat commercialization, Netanyahu also announced that he had directed Cabinet Secretary Tzahi Braverman to “appoint a body to serve these industries in order to connect and oversee all the stakeholders operating in this field.”

- Fun fact: Israel is a hotbed for cultivated meat research and commercialization, with at least five ventures launched dedicated to the sector.

4. 2020 was a breakout year for precision fermentation.

2020 was the first year that consumers have been able to buy animal-free, genuine dairy products made with precision fermentation.

- New company formation increased, with nine of the 13 newly launched fermentation companies focused on precision fermentation.

- Perfect Day had several foodservice and retail launches of its animal-free dairy ice cream, including by CPG brand Brave Robot.

- GFI held a fermentation symposium—learn more about fermentation from our session with Clara Foods, Motif Foodworks, and Perfect Day.

- As a whole, fermentation companies devoted to alternative proteins received $590 million in investments in 2020, which is more than double the amount raised in 2019.

5. Whole-cut product development is accelerating.

Whole-cut products are experiencing significant technical and commercial development.

- In the fermentation space, there were steak, chicken, bacon, and pork launches from several companies like Meati Foods, Atlast Food Co., and Prime Roots.

- Meanwhile, the plant-based sector saw developments in several technologies for creating whole muscle products, including spinning technology, shear-cell technology, and 3D printing.

- GFI’s research grant program is focusing its 2021 funding on whole muscle products.

- The alternative protein industry raised a record-breaking $3.1 billion in investments in 2020—more than in any single year in the industry’s history. This is a promising signal for the further development of nascent categories like whole-cut meat products.

6. Alternative proteins have clear momentum in beef and chicken. What’s next? Offering a critically needed reprieve for overfished oceans and at-risk biodiversity with alternative seafood.

There are now more than 60 companies across plant-based, fermentation, and cultivated platforms that have alternative seafood in their product pipeline.

- Three of eight major cultivated meat tasting events in 2020 were for seafood products, including fish fillet, sushi-grade salmon, and lobster.

- In 2020, alternative seafood companies raised more than $83 million in invested capital, four times the amount raised in 2019. What’s more, in the first four months of 2021, we have already seen more than $105 million invested in alternative seafood companies.

- U.S. plant-based seafood retail sales grew 23 percent in 2020, yet amount to only $12 million, indicating a large whitespace compared to the conventional U.S. seafood retail market worth tens of billions of dollars.

- GFI’s Sustainable Seafood Initiative is helping to turn the tide so the globe can sustainably meet the growing global demand for seafood.

7. The dollar growth of plant-based meat, eggs, and dairy at retail continues to outpace that of conventional animal products.

The global plant-based meat market grew to $4 billion, and all-time high, according to data GFI commissioned from Euromonitor.

- U.S. retail sales of plant-based foods was $7 billion, outpacing animal-based meat’s dollar sales growth by two times.

- Plant-based meat, egg, and dairy categories increased their dollar share of respective overall categories.

- See category data, household penetration growth, and more on our market data page.

8. In addition to the Singapore cultivated meat regulatory approval, 2020 saw key legal wins and setbacks as the regulatory landscape continues to unfold.

Fair public policy and an even regulatory playing field is essential for alternative proteins to succeed.

- In a milestone vote following heavy advocacy by GFI and other organizations, the European Parliament rejected a legislative proposal that would have banned the use of all conventional meat-related terms on plant-based food labels (like “veggie burger” or “plant-based steak”). The battle continues on the plant-based dairy front, after the European Parliament approved (by a small margin) new restrictions on the marketing of plant-based dairy products.

- In the U.S., Virginia and California paved the way for an even playing field for alternative proteins by blocking label censorship bills.

9. Scientific and technological developments continue to advance a promising future for alternative proteins—but more investment in R&D is needed.

- The United States, the European Union, Israel, and Singapore were among the first governments to provide support for the fermentation sector.

- In September, the U.S. National Science Foundation granted $3.55 million to support cultivated meat research at UC Davis—the largest infusion of U.S. public research dollars into cellular agriculture yet and a signal of the field’s scientific and intellectual merits.

Even with all of this promising activity, alternative proteins remain a small fraction of the global meat market—less than 1 percent. A moonshot for alternative proteins could accelerate R&D, product development, scaling, and commercialization. GFI’s two-page U.S. policy recommendations show how investing in alternative proteins will create jobs, spark infrastructure growth, and yield climate, global health, and food security dividends for decades to come.

Hungry for more? Watch our webinars analyzing the 2020 State of the Industry: