Manufacturing and producing alternative proteins

Identify product and category white spaces. Accelerate innovation. Scale the supply chain so that alternative proteins can be as accessible, affordable, and delicious as conventional animal products.

Insights in your inbox

Our monthly newsletter features the latest news and opportunities.

Market and consumer research

More than 75 percent of consumers have tried plant-based meat or are willing to try it. GFI’s consumer research helps companies understand the many consumer groups interested in alternative proteins, prioritize product attributes, and develop messaging strategies to maximize alternative protein sales. Our market research provides overviews of the business and technological landscapes, identifies trends and white space opportunities, and captures data on market sizing and purchase dynamics.

Consumer insights

GFI’s consumer insights cover consumer demographics, adoption, perceptions, attitudes, motivations, and barriers

GFI’s consumer insights identify and understand current and potential consumers for alternative proteins. With a mix of primary research and literature reviews, we cover demographics, adoption, perceptions, acceptance, motivations, and barriers. We also review category language and descriptors that drive purchase intent, as well as opportunities for future research.

GFI’s consumer research includes:

- A comprehensive literature review on consumer adoption of plant-based meat and an accompanying strategy report with key insights.

- A focus groups study on consumer perceptions of and experiences with new sources of protein.

- A study on retail point-of-purchase motivators for plant-based food.

- Studies on cultivated meat nomenclature.

- Recommended future consumer research priorities.

View our consumer insights to learn more about current and potential consumers of alternative proteins.

Retail market overview

Our insights into U.S. retail sales data for plant-based meat, egg, and dairy products include category-level data on market size, growth, and purchase dynamics

- In U.S. retail alone, plant-based foods are an $8 billion market. 6 in 10 U.S. households purchased plant-based foods in 2022, similar to prior year, and most plant-based categories maintained their dollar share of their respective categories.

- New product formats will boost category growth. Pockets of growth in plant-based meat include emerging subcategories such as plant-based chicken, seafood, and jerky. In overall plant-based foods, plant-based eggs, protein liquids and powders, bars, and dairy saw the greatest growth. There are still many plant-based product categories that are largely untapped, including whole cut meats, seafood, bacon, and additional formats of plant-based eggs.

- Global markets are emerging—and maturing. In addition to U.S. plant-based retail sales data, GFI also releases retail sales insights from 13 European countries based on data from NielsenIQ and global market estimates based on data from Euromonitor. In particular, global plant-based meat sales grew 8% by dollars and 5% by pounds, with rapid growth in Latin America and significant growth in Europe and APAC. Clearly, plant-based foods are experiencing global growth as the market develops in different regions.

Note: This data is based on custom-GFI plant-based categories that were created by refining standard SPINS categories. Due to the custom nature of these categories, the presented data will not align with standard SPINS categories.

Foodservice market overview

U.S. foodservice market insights for the plant-based meat category

We work with market research firm Circana to provide a data-driven look at plant-based meat’s sales performance in foodservice:

- 2022 was a strong year on the plant-based protein category’s path back to pre-pandemic levels. U.S. broadline distributor sales of plant-based proteins reached $304 million in 2022, growing eight percent from pre-pandemic levels in 2019. Meanwhile, unit sales declined very slightly by one percent over the same period, in line with animal-based meat sales declines.

- Analog plant-based proteins that aim to match the taste and texture of animal-based meat have the majority of the plant protein category. In 2022, products including plant-based chicken, plant-based pork, and plant-based seafood emerged as small but mighty segments, demonstrating that operators are leaning into new product offerings beyond the traditional plant-based burger. Analog products made up 53 percent of pound sales in plant-based proteins in 2022, up from 39 percent in 2019.

- Buyers of plant-based meat make roughly 30 more trips to foodservice locations per year, spending approximately $400 more than the average buyer, establishing them as very valuable customers. With the continued development of the plant protein category in foodservice, brands and operators are poised to capitalize on high-value plant-based buyers and better meet customer needs.

For more insights on the foodservice market, read our report: The rise of plant-based in U.S. foodservice and watch our accompanying webinar.

Business and technological landscape

Business and technological landscape

Our flagship State of the Industry reports provide an in-depth overview of each alternative protein production platform: plant-based, cultivated, and fermentation. The reports cover the top companies in each sector, sales data, investment analysis, technological advancements, and the latest regulatory information.

Our company database includes alternative protein brands, suppliers, ingredient companies, and manufacturers. Use the database to understand the competitive landscape and identify potential partners.

Product innovation guidance

Pioneering innovators in the alternative protein sector have jump-started a virtuous cycle of product and technology innovation, customer acquisition, investment, and scaled production. Recent years have seen several scientists, entrepreneurs, and corporations developing innovative ingredients, paradigm-shifting technological advances in production, and leading-edge marketing strategies.

Our guidance and resources help enable the food industry to deliver plant-based, cultivated, and other alternative protein products that compete on the key drivers of consumer choice: taste, price, and convenience.

Taste, price, and convenience

Innovate on taste

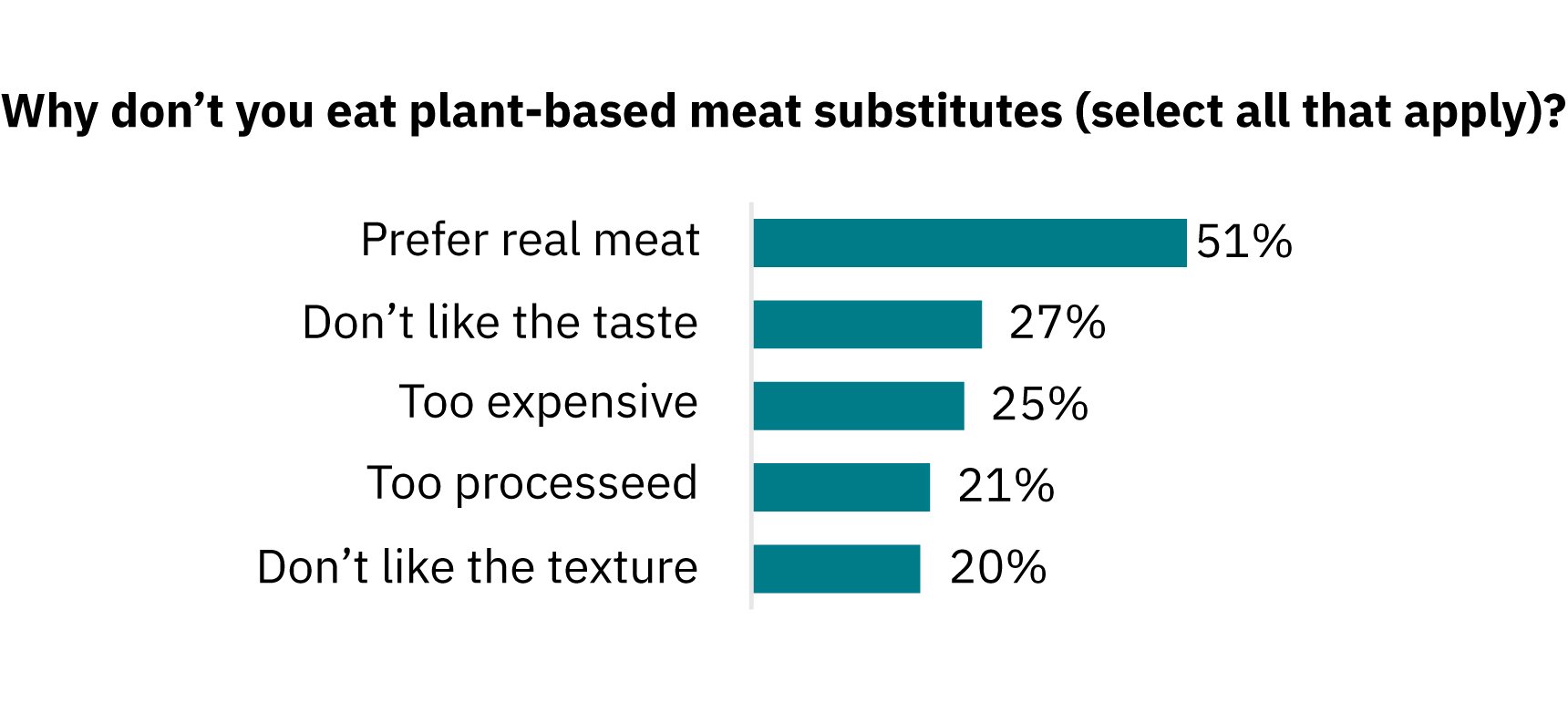

Taste is a primary motivator for consuming plant-based foods—and, simultaneously, the main barrier to consumer adoption.

- Seventy-three percent of consumers agree that plant-based meat should mimic the taste of meat.

- Forty-seven percent of consumers want more variety in plant-based meats.

- Fifty-one percent of consumers want more variety in protein sources for plant-based meat.

Close the price gap

Across categories, plant-based products are priced at a premium compared to animal-based products. Consumers say price is second only to taste in importance as an attribute when considering purchasing plant-based meat.

- Most consumers said they would pay less or the same for plant-based products compared to animal-based products.

- Only 27 percent said they would consider paying more.

Convenience appeals to all

Increasing access to plant-based food in mainstream grocery stores and restaurants is resulting in adoption from the largest group of consumers — omnivores.

- Seventy-six percent of consumers want to find plant-based meat in the meat aisle and frozen area where they already shop.

- Millennials rank convenience more highly than other groups do, and care about the ease of cooking & preparation.

To increase adoption of plant-based meat, manufacturers should consider:

- Creating delicious products that mimic the sensory qualities of animal products, including texture, smell, and taste.

- Scaling up production and pursuing technical innovation so alternative protein products reach price parity with conventional meat.

- Advocating for their products to be shelved in the meat aisle where most consumers seek out center-of-plate proteins.

For a deeper dive into the consumer insights that inform our recommendations, including product development, choice architecture, and consumer messaging, please check out our report on Strategies to Accelerate Consumer Adoption of Plant-Based Meat and visit our consumer insights.

Plant protein ingredients and processing

Our Plant Protein Primer is the go-to resource for understanding different plant-based protein sources. It includes an analysis of 19 plant protein sources with a summary comparing these sources on nutrition, functionality, price, flavor, and sourcing. For a quick glance, download the Plant Protein Landscape summary.

View our Plant-Based Meat Manufacturing by Extrusion Guide for an overview of plant-based meat processing and directories of ingredients, pilot facilities, co-manufacturers, and related events.

Scientific overview

Join the thousands of people who have signed up for GFI’s massive open online course on the science of plant-based and cultivated meat. The six-session self-paced course covers the biological and chemical processes used to produce plant-based and cultivated meat, the environmental and economic drivers behind these sectors, and the dietary roles of proteins.

Visit GFI’s in-depth pages on the science of plant-based protein, cultivated meat, and fermentation for a deep dive into these production platforms.

Technical resources

Selling into retail

GFI works directly with leading retailers to increase sales of plant-based foods by offering best practices on assortment, merchandising, and marketing.

View our retail resource page to learn which retail strategies can increase sales of plant-based meat, eggs, and dairy and grow total store sales.

Marketing plant-based foods

Our primary consumer research and literature reviews contain insights for labeling and marketing language that appeal to consumers and drive purchase intent:

- Marketing and Promoting Plant-Based Proteins offers insights for retailer promotion as well as labeling of individual products.

- GFI’s Retail Point-of-Purchase Motivators for Plant-Based Foods study provides effective category descriptors, product attributes, and packaging.

- Our Strategies for Accelerating Adoption of Plant-Based Meat paper highlights evidence-based best practices for product development and messaging.

Labeling guidance

A well-crafted product label can promote first-time purchases of plant-based products. Once consumers have tried plant-based products, they’re highly likely to buy them again.

Evidence-based product labeling recommendations:

- Use “plant-based” or “plant protein” as product descriptors.

- On-product health labels should focus on positive health benefits like “high protein” or “high fiber” instead of restrictive language like “low fat.”

- Develop positive messaging around the taste and sensory properties of plant-based meat. Use indulgent language that emphasizes product taste and the experience and enjoyment of eating.

- Highlight plant-based meat’s similarity to conventional meat in its ease and quickness of preparation.

- Message about altruistic benefits sparingly or only alongside appeals to traditional core drivers of food choice – taste, price, convenience, and familiarity.

- Emphasize plant-based meat’s increasing acceptability and prevalence.

- Design message content and framing with omnivores in mind.

For the rationale behind each of these tips, review the Strategies to Accelerate Consumer Adoption of Plant-Based Meat paper.

Selling into foodservice

Selling a product into foodservice offers a number of benefits for plant-based manufacturers:

- Guaranteeing your product is prepared in a standardized way before it reaches the consumer’s plate.

- Selling products at a premium.

- Reaching consumers who may not try it otherwise.

A growing body of evidence suggests that alternative proteins are a key growth driver for restaurants, helping them attract new customers and raise check sizes. View our foodservice resources for market data, menu ideas, and strategies for launching successful plant-based items in restaurant and non-commercial foodservice channels.

Quick tips for selling into foodservice

Here are three key tips for plant-based companies selling into foodservice:

Make foodservice sales sheets easily available on social media and your website.

Emphasize the versatility of your products and show the applications and dishes they can be used for. Share data on how you can attract new customers, raise check averages, and/or lower costs. Include per-serving costs to make it easy for operators to calculate profitability.

Tasting and testing are believing.

Do product training and tastings with your distributor sales teams and chefs. Also work with your operator prospects and partners on recipe development. Finally, partner with foodservice management companies and chef training groups like Forward Food to get your products in front of key decision makers.

Make taste the primary message.

Always emphasize flavor in your marketing and empower your foodservice partners to keep tastiness top-of-mind by providing image and descriptive assets they can repurpose.

Marketing and menu design

Key recommendations for effective plant-based product marketing and menu design include:

Lead with flavor.

Use indulgent language to emphasize that your product will offer familiar, craveable experiences consumers want.

Embrace the health benefits of plant-based.

Health is a key driver of interest in plant-based proteins; use health-positive language that highlights benefits, not what’s missing. These messages appeal to the nutritional halo of plant-based foods.

Position plant-based dishes to succeed with flexitarians.

List plant-based dishes alongside other items rather than in a separate vegan/vegetarian section where they won’t be seen.

Label dishes as “plant-based” or “plant protein.”

Favor more inclusive terms like “plant-based” or “plant-protein” over the terms “vegan” or “vegetarian” to appeal to more consumers and increase purchase intent.

Make plant-based options the default.

Make protein an optional add-on and include plant-based protein offerings.

Sign up for our industry newsletter

Finding these resources helpful? Get notified when GFI releases new resources and opportunities by signing up for our newsletter!

"*" indicates required fields

Engage with GFI

GFI’s work enables our food industry partners to develop and market plant-based, cultivated, and other alternative protein products. We work with consumer packaged goods companies, large food and meat companies, and alternative protein companies. GFI’s experts analyze the market, uncover consumer insights, identify whitespace opportunities, provide advice, make industry connections, and build communities. We do all this to enable the food industry to deliver alternative protein products that compete on the key drivers of consumer choice: taste, price, and convenience.

Specifically, we provide guidance to:

- Entrepreneurs and startups seeking to bring their ideas to market and fast-track growth.

- Manufacturers developing and bringing to market the next generation of alternative protein products.

- Ingredient companies creating the next generation of alternative protein ingredients and optimizing raw materials, inputs, and functional additives.

- Suppliers creating the next generation of ingredients and inputs, processing services, and other enabling technologies.

- Equipment manufacturers developing and commercializing equipment optimized for alternative protein production at scale.

We can also work under NDA to offer input at critical milestones in product development and provide marketing guidance to maximize sales.

Page

Environmental, Social, and Governance framework

GFI & FAIRR’s ESG frameworks supply investors and companies in the alternative proteins industry with tools to monitor, measure, and report on risks and opportunities.

Resources for manufacturers

Resource

Consumer insights

Understand consumers, demographics, adoption, motivations, category descriptors, and opportunities for future research in alternative proteins.

Innovation opportunities for manufacturers

GFI has identified specific commercial white spaces that offer clear business opportunities for manufacturers in the industry. View our full solutions database for further ideas.

-

Cultivated

-

Fermentation

-

Plant-Based

Forging product development partnerships among ingredient suppliers and manufacturers

Opportunities exist to coordinate product development partnerships between ingredient suppliers, strategic partners, and product manufacturers to directly engage more holistically on product formulation.

-

Plant-Based

Fiber spinning innovations for improved plant protein texturization

Fibers from non-traditional texturization techniques like electrospinning, jet spinning, or blow spinning could impart texture throughout a product even if they don’t comprise the bulk of the end product, which…

-

Plant-Based

Expanded product development in plant-based meat snacks

Plant-based meat snacks could tap into underlying trends in snacks replacing meals and increased consumer interest in high-protein, low-sugar foods. Product innovation is needed to match the taste, price, and…

-

Plant-Based

Next-generation plant-based turkey products

There has been little in the way of publicly-announced R&D or commercial efforts to develop the next generation of tasty and affordable plant-based turkey products. There is room for innovation…