When will the price be right?

Reducing the price of alternative proteins

People from all walks of life and in every corner of the planet want our food system to be just, sustainable, and secure. Studies consistently show that price is a key driver of consumer interest in alternative proteins, along with taste and accessibility. To compete with conventional products, alternative proteins must achieve levels of affordability that unlock the largest market—omnivores.

GFI’s new resource, Reducing the price of alternative proteins, offers an overview of the current price and cost landscape and where we’ll go from here. We’ve broken down three of the key findings for you here:

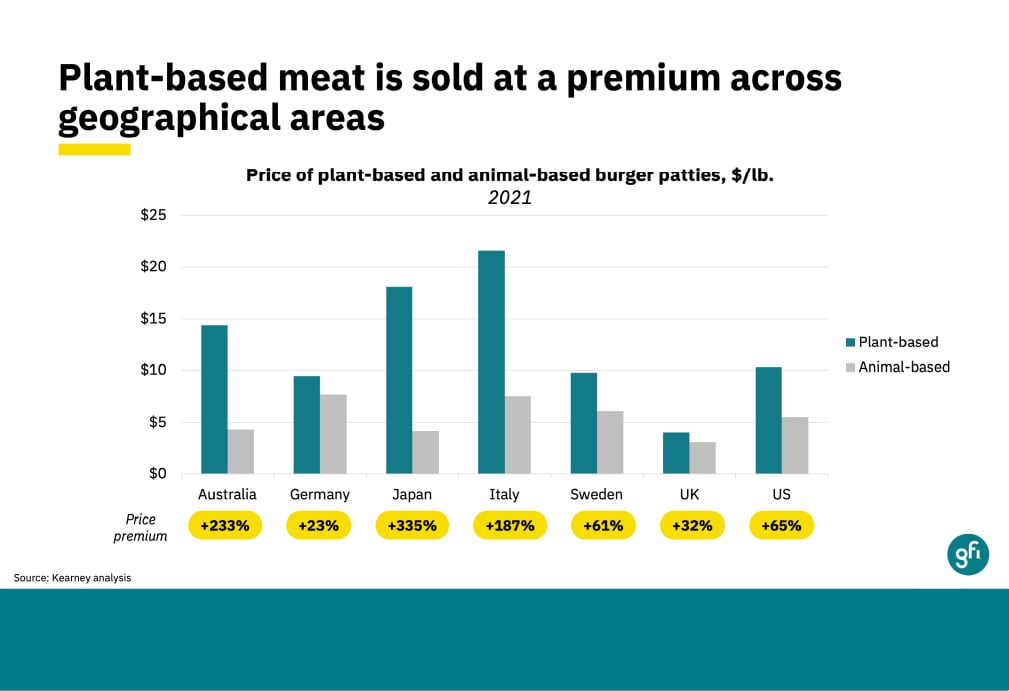

1. How affordable are current plant-based products on the market today as compared to animal products?

Plant-based meat products are currently priced at a significant premium across categories. We anticipate this gap shrinking as plant-based producers increasingly scale up production, achieve economies of scale, and seek price parity with their conventional competitors. Indeed, the price gap is smaller for more developed categories like milk and butter—as can be seen in the full resource.

2. What are the consumer’s perceptions about the price of plant-based products? Are they willing to pay a premium?

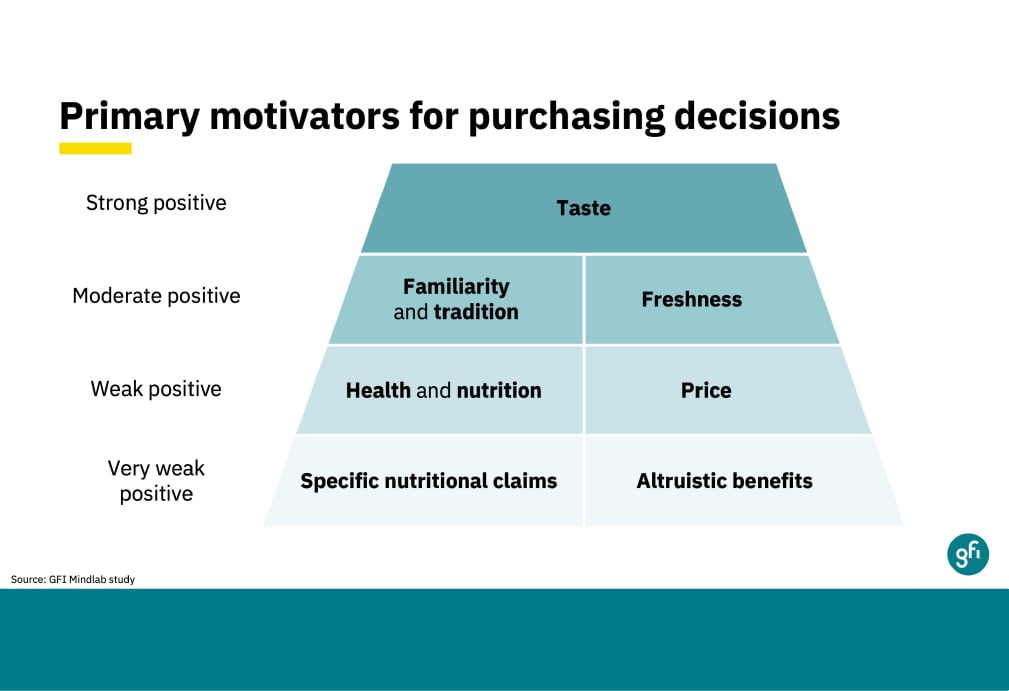

Understanding how consumers prioritize price and perceive the value of plant-based meat, eggs, and dairy can guide business decisions across the supply chain—supporting further R&D investment, influencing ingredient selection, and considering marketing messaging and product pricing.

A study GFI conducted with Mindlab investigated price as a driver of purchase intent and the willingness of consumers to pay more for plant-based products. When explicitly asked, consumers ranked price as the second-most important factor (behind taste) to encourage or discourage them from purchasing a plant-based product.

In the current market landscape in which the price of alternative protein products are higher than those of conventional products, price can limit consumer adoption. According to a Mintel study, among adults who do not currently consume meat alternatives, 20 percent point to high price as a barrier.

For most consumers, closing the price gap would likely increase the purchase intent of plant-based products. The largest group of consumers is willing to pay only the same price for plant-based products as for their conventional counterparts. Approximately ¾ of consumers are willing to pay the same price or less.

3. What is the pathway to price parity for plant-based and cultivated meat and what cost drivers will help prices go down as the industry scales up?

As alternative protein production scales up, economies of scale can translate into cost and price efficiencies. We’ve already started to see progress on reaching price parity in select categories:

Existing momentum in plant-based meat

- In early 2021, Impossible Foods announced its second price reduction within a year for its plant-based grounds, decreasing the suggested retail price to $9.32/lb, a 20% drop.

- Beyond Meat has said that it aims to underprice animal protein in at least one category by the end of 2024.

- In 2020, Trader Joe’s launched its plant-based burger patties made with pea protein priced at $4.49 for two quarter-pound patties.

- Also in 2020, Kroger launched its plant-based chicken grounds priced at $6.99 for a one-pound package.

- In October 2021, Aldi launched its Ultimate No Beef Burger in UK stores, priced at £1.99 for two quarter-pound patties, or approximately $5.30 per pound.

Progress on price parity is not only affected by reducing plant-based meat production costs, but also by market effects that raise conventional meat costs. Recent pressures such as higher input costs, meatpacker labor issues, higher worker wage rates, and supply chain interruptions have illustrated the relative volatility—and price instability—of the conventional meat supply chain. In fall 2021, conventional meat categories like beef, chicken, and pork have seen double-digit price increases compared to the same week in 2020, while plant-based meat prices compared to prior year have decreased or remained the same.

Rational optimism for cultivated meat

At GFI, we’re rationally optimistic about the future of cultivated meat and we’re building a roadmap to get there. Our cultivated meat techno-economic assessment found that at a production cost of $2.92 per pound (or $6.43 per kilogram), cultivated meat could be cost-competitive with some conventional meats by 2030 and serve as an affordable ingredient for plant-based and cultivated meat blends.

Projections on price parity

Blue Horizon and BCG published a report that forecasts when each alternative protein category will reach cost parity with conventional meat, emphasizing that each alternative protein production platform is currently at a different stage.

Relative timing of cost parity for alternative proteins with realistic taste and texture

Note: This analysis includes illustrative data for US and EU; variations by product group and geographic area are omitted for clarity.

Page

Reducing the price of alternative proteins

Along with taste and accessibility, price completes the trifecta of key drivers of consumer interest in alternative proteins. In order to compete with conventional products, alternative proteins must achieve levels…