What U.S. consumers want in alternative seafood products

There is an urgent and sizable need for new approaches to meet increasing global demand for seafood, and alternative seafood is well poised to meet that demand. However, as the alternative protein industry continues to grow, with plant-based retail sales reaching $7 billion in 2020, alternative seafood remains a significant white space.

To date, little research has been conducted on consumer attitudes towards alternative seafood. To fill this gap, GFI partnered with consumer insights and brand strategy firm, Kelton Global, to determine U.S. consumer needs, preferences, and motivations as they relate to choosing alternative seafood. This study surveyed 2,500 U.S. residents ages 18 to 65, with the sample reflecting nationwide population demographics. The results illustrate which consumers are interested in alternative seafood and why, offering key insights for industry players to better appeal to potential consumers and propel the entire industry forward.

Alternative seafood is well positioned to appeal to general consumers

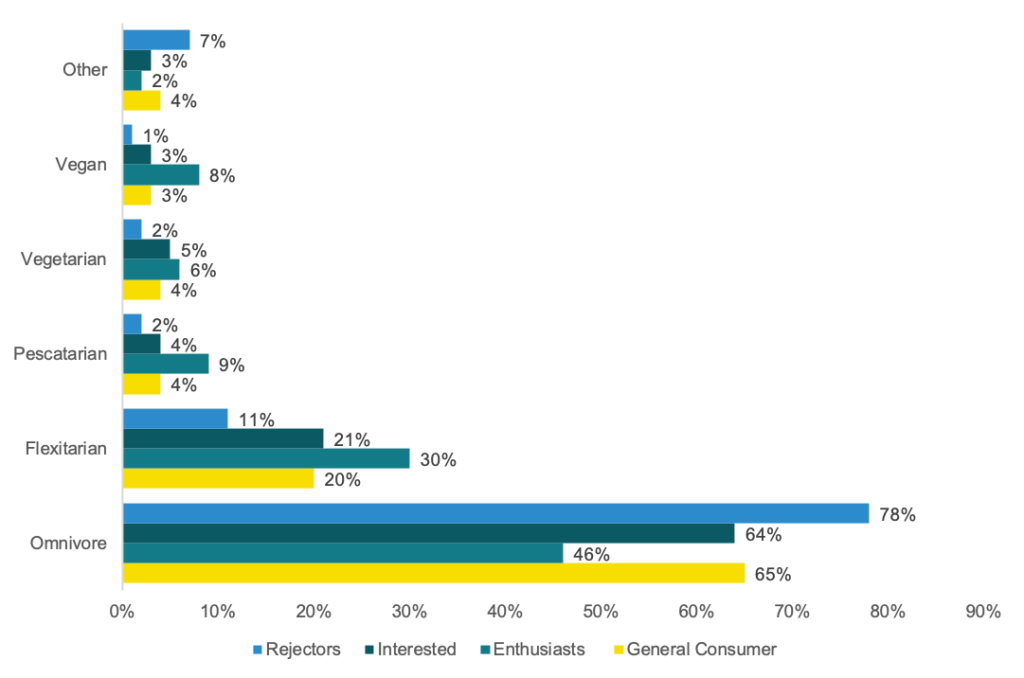

Participants in this study were grouped into three categories—alternative seafood enthusiasts, alternative seafood interested, and alternative seafood rejectors—based on how appealing they found plant-based or cultivated seafood and how likely they were to purchase either. Notably, a greater proportion of alternative seafood enthusiasts are flexitarian and pescatarian than the general consumer. Alternative seafood is therefore already appealing to groups beyond vegans and vegetarians.

Alternative seafood enthusiasts are more likely to identify as flexitarian or pescatarian

Taste and texture are table stakes

Consumers repeatedly cited taste and texture as the most important factors in determining whether or not they would eat alternative seafood products. When asked which functional factors were most important in choosing alternative seafood over conventional seafood, the majority of consumers cited flavor as most important, followed by food safety, tasting like conventional seafood, and texture. When asked why they might not choose alternative seafood, most consumers also cited anticipated taste and texture as barriers to choosing alternative seafood.

Environmental, health, and functional benefits messaging draws in additional consumers

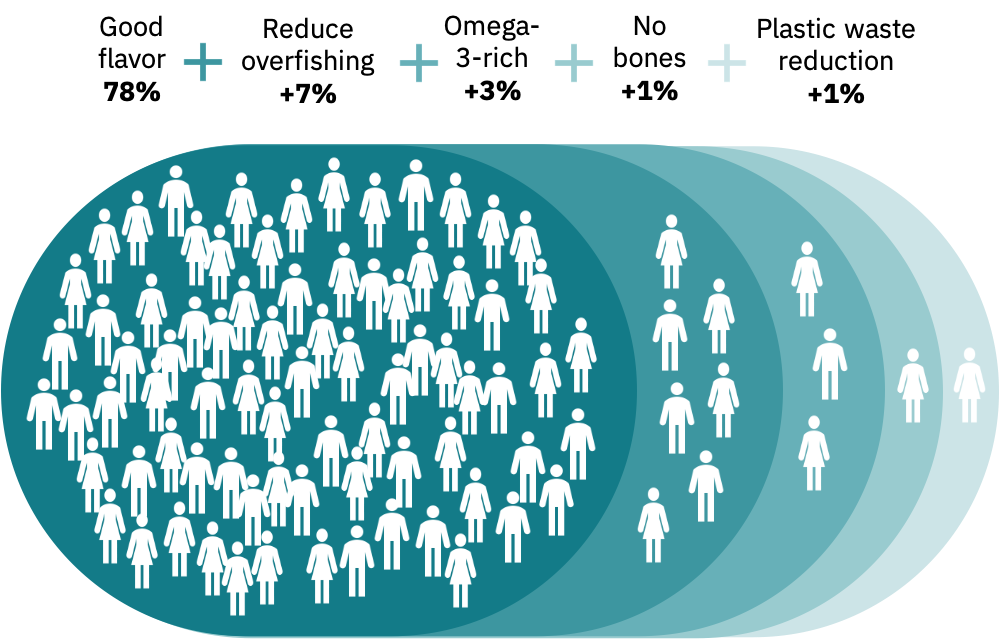

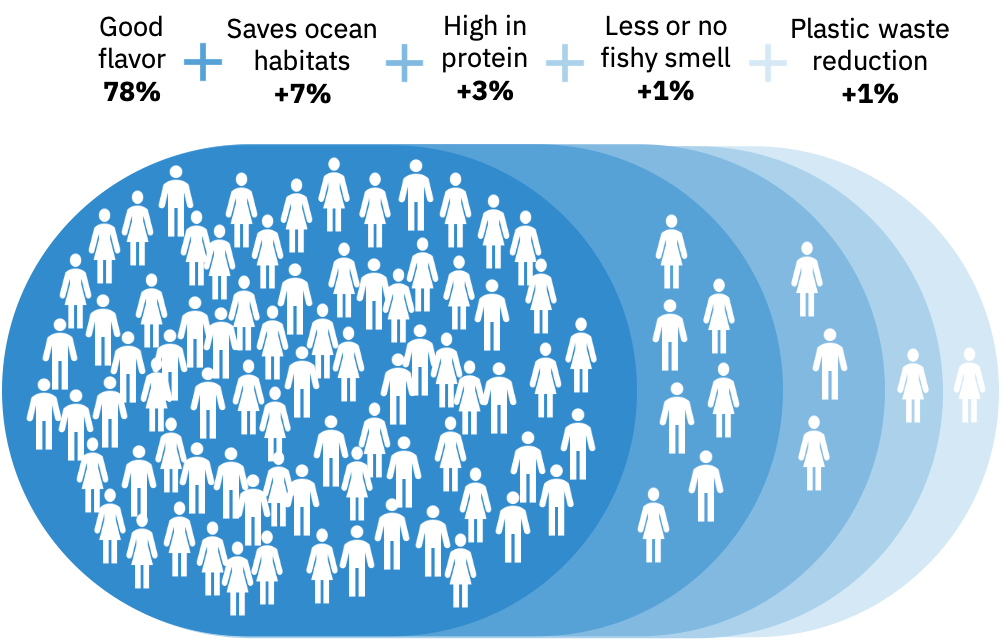

Proper messaging about alternative seafood benefits is crucial to consumer trial and adoption. 78 percent of consumers would try plant-based and cultivated seafood based on flavor messaging alone.

Once consumers have a positive impression of alternative seafood flavor, messaging focused on these products’ environmental, health, and functional benefits are likely to bring additional consumers into the category. For cultivated seafood, messaging about these products’ ocean habitat benefits, protein content, lack of “fishy” smell, and reduction in plastic waste produced by ocean fishing can generate additional gains in reach. And for plant-based seafood, messaging about reduction in overfishing and plastic waste from fishing, high omega-3 content, and lack of fish bones can generate additional gains in reach.

Plant-based seafood messaging attributes TURF (total reach)

Cultivated seafood messaging attributes TURF (total reach)

Consumers showed equal interest in plant-based and cultivated seafood

Consumers consistently ranked plant-based and cultivated seafood motivations and barriers in the same order of importance. This was true for environmental and health and functionality benefits—with only a few negligible differences in the functionality category. After learning about plant-based and cultivated seafood, 42 percent of consumers found plant-based seafood appealing and 43 percent would consider purchasing it in the future. 35 percent of respondents found cultivated seafood appealing and 38 percent would consider purchasing it in the future.

Opportunities in alternative seafood

As incomes rise and population increases, the United Nations projects an increase in demand for seafood of more than 45 million tons between the mid-2010s and early-2020s. In the short term, we could see as much as a 30 percent increase in global demand in the coming decade. This consumer research shows that both plant-based and cultivated seafood are well poised to appeal to the general consumer in the United States, and play a huge role in meeting the growing demand for seafood in a more sustainable way.

To successfully meet this global demand with alternative seafood, we need to develop a more complete picture of global seafood consumers’ needs, preferences and motivations. Additional consumer research in other geographic regions such as Asia and Europe, where seafood consumption is highest globally, would provide critical insights needed to broaden the alternative seafood industry’s reach and adoption. Sensory research and evaluations are also needed to better understand how the seafood products currently on the market are meeting consumer’s sensory expectations and where key product development opportunities lie.

Open-access research can help us answer these key questions and ultimately propel the alternative seafood industry forward. In support of a better food future, GFI’s Sustainable Seafood Initiative will continue to support open-access research to maximize the likelihood of success for alternative seafood over time.