Plant-based food retail sales are growing 5x total food sales

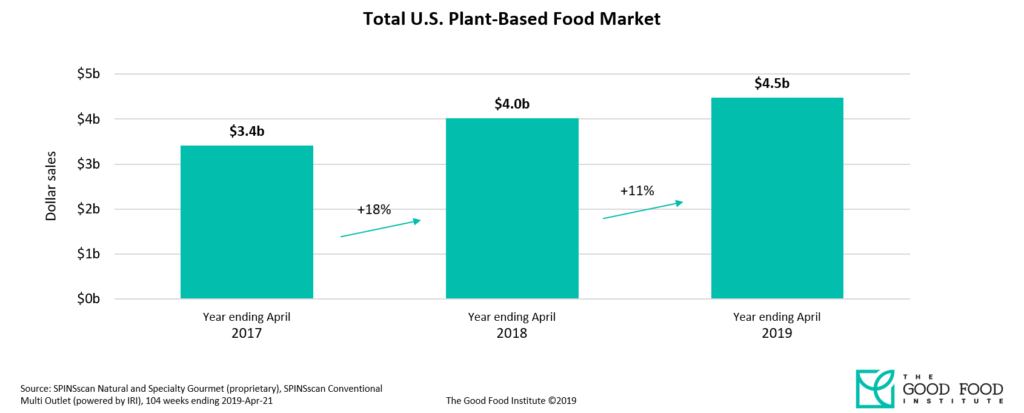

New data show that the U.S. plant-based foods retail market is worth $4.5 billion. It grew five times faster than total U.S. retail food sales over the past year.

GFI and the Plant Based Foods Association commissioned this data from leading market research firm SPINS. We used SPINS “plant-based positioned” product attribute and then drilled down into the data for plant-based foods that directly replace animal products (e.g., meat, seafood, eggs, and dairy) as well as meals that contain animal ingredient replacements.

Here’s the short story: plant-based food is where the growth opportunity for retailers is.

Now, here’s the deeper dive!

Plant-based dairy

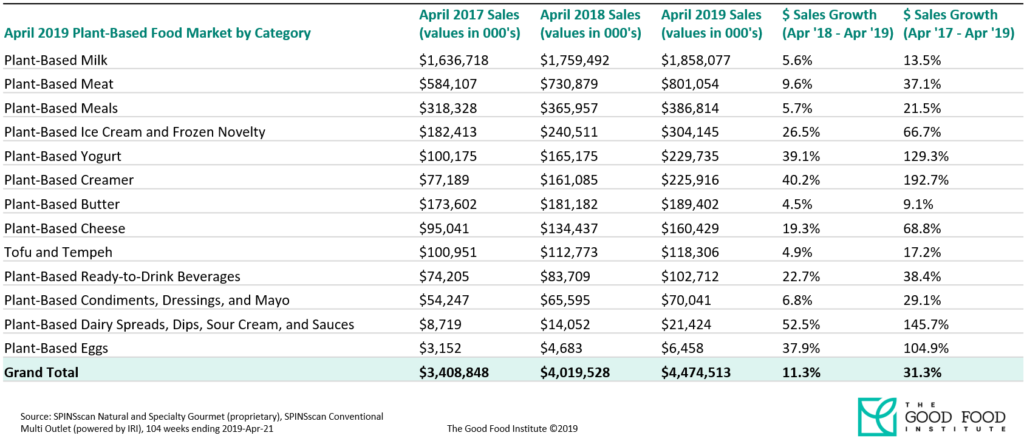

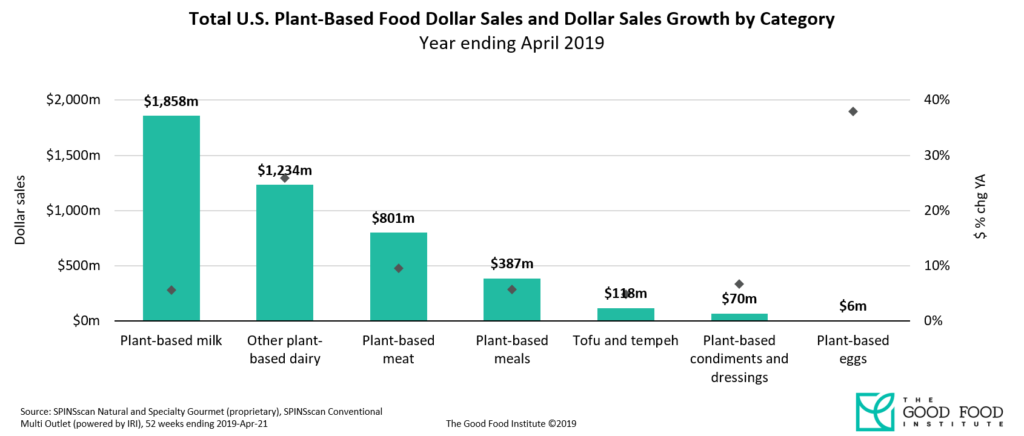

Plant-based milk continues to set the curve for plant-based food retail sales. This category now makes up 13 percent of total retail milk sales, growing 6 percent in the past year. In the same time period, cow’s milk sales declined 3 percent (and they declined 3 percent the prior year as well).

Emerging plant-based dairy categories like yogurt, cheese, and ice cream are growing even faster as more households discover these other plant-based dairy options:

- Plant-based yogurt grew 39 percent in the past year (conventional yogurt declined 3 percent);

- Plant-based cheese grew 19 percent (conventional cheese remained flat);

- And plant-based ice cream and frozen novelty grew 27 percent (conventional ice cream and frozen novelty grew 1 percent).

The accelerating interest in plant-based products is pushing the industry into the mainstream market. Retailers can capture this momentum in their own bottom line by increasing the variety and accessibility of plant-based foods. For plant-based meat, eggs, and dairy, accessibility includes adjacency to conventional animal products, where they are easy for everyone to find.

Plant-based meat

And indeed, we’re already seeing the impact that strategic shelf space can have. Total plant-based meat is now worth $800 million, accounting for 2 percent of U.S. retail packaged meat sales. Retailers increasingly shelve plant-based meat in the refrigerator section, alongside conventional animal meat, introducing a wider range of consumers to these products and putting all “center of plate proteins” in one convenient place. Consequently, refrigerated plant-based meat sales have taken off to the tune of 37 percent growth over the past year.

“This is just the beginning of a massive growth period for plant-based foods,” said GFI associate director of corporate engagement Caroline Bushnell. “Consumer appetite for plant-based foods is surging as consumers increasingly make the switch to foods that match their changing values and desire for more sustainable options. This growth will continue as more companies bring next-generation innovations to market that really deliver on the most important driver of consumer choice: taste.”

Check out the full suite of insights here.

About the data

The data summarized here represents U.S. retail sales of plant-based foods that directly replace animal products, including meat, seafood, eggs, and dairy, as well as meals that contain animal ingredient replacements. This data covers the grocery marketplace and was obtained over the 52-week and 104-week periods ending December 29, 2019, from the SPINSscan Natural, Specialty Gourmet, and Conventional Multi Outlet (powered by IRI) channels. The data is based on custom-GFI plant-based categories that were created by refining standard SPINS categories. Due to the custom nature of these categories, the presented data does not align with standard SPINS categories.

1,2 The Food Industry Association & IRI. (2020). Understanding the plant-based food consumer [Webinar].

*Note: SPINS does not report non-UPC meat counter sales. To account for this, the plant-based meat total retail share calculation uses the $95 billion total meat market size reported by Nielsen, as this number includes both retail packaged meat sales and non-UPC meat counter sales.