Merchandising plant-based meat, eggs, and dairy at retail

More and more consumers are adding plant-based meat, eggs, and dairy to their carts. Learn what merchandising strategies help manufacturers best capitalize on the growing plant-based market.

Key merchandising strategies

Successful plant-based merchandising strategies target omnivores and flexitarians.

The isolated “vegan” sections that have dominated plant-based merchandising for years make shopping easy for committed plant-based consumers. However, these are a small fraction of consumers—only about four percent of the U.S. population is vegetarian and one percent as vegan, according to a 2023 Gallup poll.

Today, 95 percent of consumers who purchase plant-based meat also purchase conventional animal meat. Thus, we recommend targeting the largest segment of consumers: omnivores and flexitarians.

Integrated-segregated merchandising

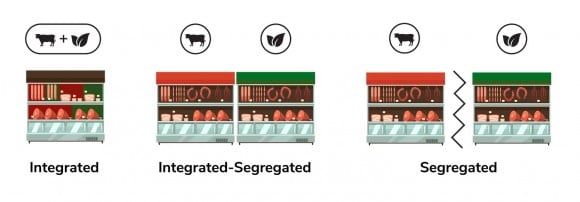

We recommend shelving plant-based meat, eggs, and dairy next to conventional items in an adjacent, but separate, plant-based set. This is an integrated-segregated merchandising strategy.

The natural and organic category demonstrates the value of an integrated-segregated strategy. Retailers who shelved natural and organic products alongside their conventional counterparts increased natural and organic product sales along with total category sales. This same logic—and the resulting sales growth—is driving retailers to use an integrated-segregated strategy for plant-based products as they move from niche to mainstream.

The difference between integrated and segregated strategies

For categories with a small selection of plant-based products, such as plant-based eggs, a fully integrated strategy may be a good option. This means shelving plant-based products and conventional products shelved together.

A segregated strategy can be much less effective for plant-based foods because it isolates these products in a separate stand-alone set. When plant-based options are not displayed alongside conventional meat, egg, or dairy products, fewer people see the plant-based options and have the opportunity to buy them.

It’s all about empowering the consumer to understand the choices and make a decision right where they are already shopping.

Why retailers should consider an integrated-segregated strategy

- Increase sales. This shelving approach allows consumers to shop in their go-to area and easily compare between plant-based and animal-based products. This encourages people to try new options and creates the opportunity trade up to premium products, which ultimately increases revenue for retailers.

- Make the customer happy. 76 percent of all consumers prefer to shop for plant-based meat in the meat or frozen section, compared with 24 percent who prefer the produce area.

- Keep up with the competition. In our Retail Report, we found that 65 percent of the top 15 retailers merchandise at least one refrigerated plant-based meat product in the meat aisle.

Learning from plant-based milk

Moving plant-based milk to the refrigerated milk set a decade ago was key to introducing the mainstream consumer base to the category. This change dramatically increased the number of households in the U.S. buying plant-based milk (now 44 percent). Plant-based milk now accounts for 15 percent of milk sales, and sales volume continues to shift toward the refrigerated set.

Comparing refrigerated and shelf-stable plant-based milk

Refrigerated plant-based milk

89 percent of 2023 plant-based milk sales

Dollar sales growth of 1 percent in 2023

Shelf-stable plant-based milk

11 percent of 2023 plant-based milk sales

Dollar sales growth of 2 percent in 2023

Page

Retail sales data: Plant-based meat, seafood, eggs, dairy

Explore 2021 U.S. retail sales data for plant-based meat, seafood, egg, and dairy products. Our report presents key category insights and purchase dynamics for the plant-based industry.

Shelf tags and aisle signage

Retailers should also use “plant-based” aisle signage and shelf tags to communicate store location and product features to customers.

Credit: The Good Food Institute

Aisle signage at King Soopers clearly labels plant-based products in the meat department.

Credit: Target

Shelf tags at Target identify plant-based and vegan foods with recognizable icons.

Credit: Sprouts

Shelf tags at Sprouts highlight plant-based products as part of a promotion.

Appealing to more customers

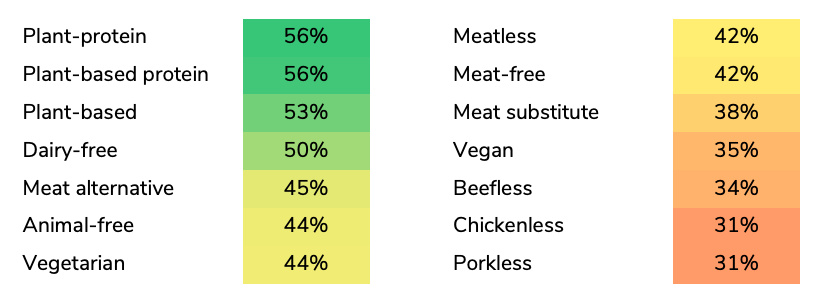

Effective aisle signage makes plant-based products easier for customers to locate. Signage that uses inclusive language, like “plant-based,” “plant-powered,” and “plant-protein,” instead of “vegan,” or “vegetarian,” appeals to a wider range of customers and does not limit the consumer base to vegans and vegetarians.

A Mindlab/GFI study on the implicit perceptions of the plant-based category showed that consumers are more likely to purchase plant-based products when descriptors like “plant-protein” or “plant-based” are used. Notably, “plant” terms paired with “protein” are most likely to increase purchase intent. All “plant” terms perform better than restrictive language, such as “vegan,” “vegetarian,” and free-from terms (such as “meat-free”).

The protein department of the future

These merchandising changes are all part of a big-picture shift. The meat department as we know it is transforming into a protein department—serving up conventional protein alongside plant-based protein.

Our vision for the protein department of the future includes:

- Featuring plant-based refrigerated cases next to conventional cases.

- Displaying plant-based value-add and blended meats in the butcher case.

- Containing frozen plant-based meat in coffin cases in the main meat department.

This Protein Department of the Future presents a world of opportunity. The plant-based meat category today is reminiscent of the plant-based milk category in its early stages of rapid growth, when it was first moved from the center-of-store to the refrigerated dairy case.

Plant-based meat could reach market share parity with plant-based milk at a 13-point gain of total retail meat market share. This growth, according to Nielsen, would be worth more than $12 billion.

Case studies of successful plant-based strategies

A growing body of evidence supports our recommended merchandising strategies. Data from The Kroger Co. and Heinen’s Fine Foods bolsters the case for shelving plant-based meat products in the meat aisle.

Kroger study demonstrates sales increase

The Kroger Co., in collaboration with the Plant Based Foods Association, released results from a study on merchandising plant-based meat in the meat department. The study, which ran from December 2019 through February 2020 at 60 test stores, placed plant-based meats in a dedicated 3-foot set within Kroger’s meat department. Across test stores, plant-based meat sales increased an average of 23 percent compared to the control group.

This test provides one more proof point that plant-based meats have moved from niche to mainstream. Kroger continues to experience double-digit growth in the plant-based category, and this test demonstrates the viability of shifting product placements to reach even more customers.

Sean Brislin, Kroger Merchandising Director

Heinen’s successfully integrates across categories

As one of the first chains to integrate plant-based categories with their conventional counterparts, Heinen’s Grocery Store is also proving out integrated-segregated merchandising across plant-based categories.

Chris Foltz, Heinen’s Chief Innovation Officer, said the retailer’s decision to integrate plant-based foods was driven by a desire to stay relevant, fulfill shopper needs, and appeal to the large consumer base looking for plant-based options. GFI worked with Heinen’s to explore ways to elevate plant-based and become a more health-forward, innovative partner to customers. As a result, Heinen’s adopted an integrated-segregated model for plant-based categories across the store, including in the meat aisle.

“Not only did we need those solutions, but we needed them across all categories and not just in one section of the store,” said Foltz. With GFI’s help, Heinen’s focused on categories with large opportunities—meat, dairy, frozen, and deli—and collaborated with their wellness team to build out two full doors in the meat department.

Heinen’s also hosted activities such as product tastings, cooking demonstrations, and cart makeovers two times per week, with educated associates and nutrition experts to engage customers.

Heinen’s found that 50 percent more customers shopped the meat section than the deli section where plant-based meat products were previously shelved—meaning the move swelled consumer exposure. Similarly, Foltz said shifting plant-based dairy products to the dairy aisle doubled the consumer exposure to plant-based dairy.

These gains played out in sales as well. After incorporating the merchandising changes across the store, Heinen’s saw a 43 percent year-on-year increase in dollar sales of plant-based meat in the year ending March 25, 2020, and a 106 percent increase compared to the prior two years.

Gone are the days when plant-based meat was confined to the produce aisle. Plant-based food is here to stay, and it’s growing rapidly. For retailers to capitalize on this opportunity, they should ensure plant-based meat is merchandised where consumers are already shopping for center-of-plate protein—in the meat aisle.

Resource

Good Food Retail Report

Learn plant-based sales strategies and see how the top 15 U.S. grocery retailers rate on their plant-based assortment, merchandising, and marketing.

Related resources

Marketing and promoting plant-based proteins

This quick guide offers evidence-based marketing and promotion strategies to increase plant-based sales at retail.

Consumer insights

Understand alternative protein consumer segments, demographics, adoption, motivations, and perceptions.

Plant-based retail market overview

Explore sales data for plant-based meat, egg, and dairy products in the U.S. retail market. Find key category insights, size, sales growth, and purchase dynamics for the plant-based industry.

State of the Industry: Plant-based meat, seafood, eggs, dairy, and ingredients

This report details the commercial landscape, sales, investments, innovation trends, and regulatory developments in the plant-based meat, seafood, egg, dairy, and ingredients industry.