Plant-based meat consumer segmentation

This study identifies the addressable market for plant-based meat and profiles six consumer segments with distinct demographics, attitudes, needs, and behaviors, providing a framework for understanding the unique types of consumers in the market.

Explore the reports

The emerging plant-based meat consumer

The U.S. plant-based meat category experienced significant growth over the past 10 years, driven by product innovation and marketing strategies targeting conventional meat-eating consumers. Many Americans have now tried plant-based meat and even more express interest. However, a minority currently buy regularly, and even fewer buy frequently.

Expanding beyond these early adopters to the mainstream market and increasing frequency are key levers to grow plant-based meat consumption. At this stage of category development, it is imperative to better understand the unique segments of consumers that exist and their attitudes and behaviors toward the category.

Key findings

- The addressable market for plant-based meat includes almost three-quarters (71%) of U.S. consumers aged 18-59 who say they are at least “somewhat likely” to eat plant-based meat and/or plant-based dairy in the future.

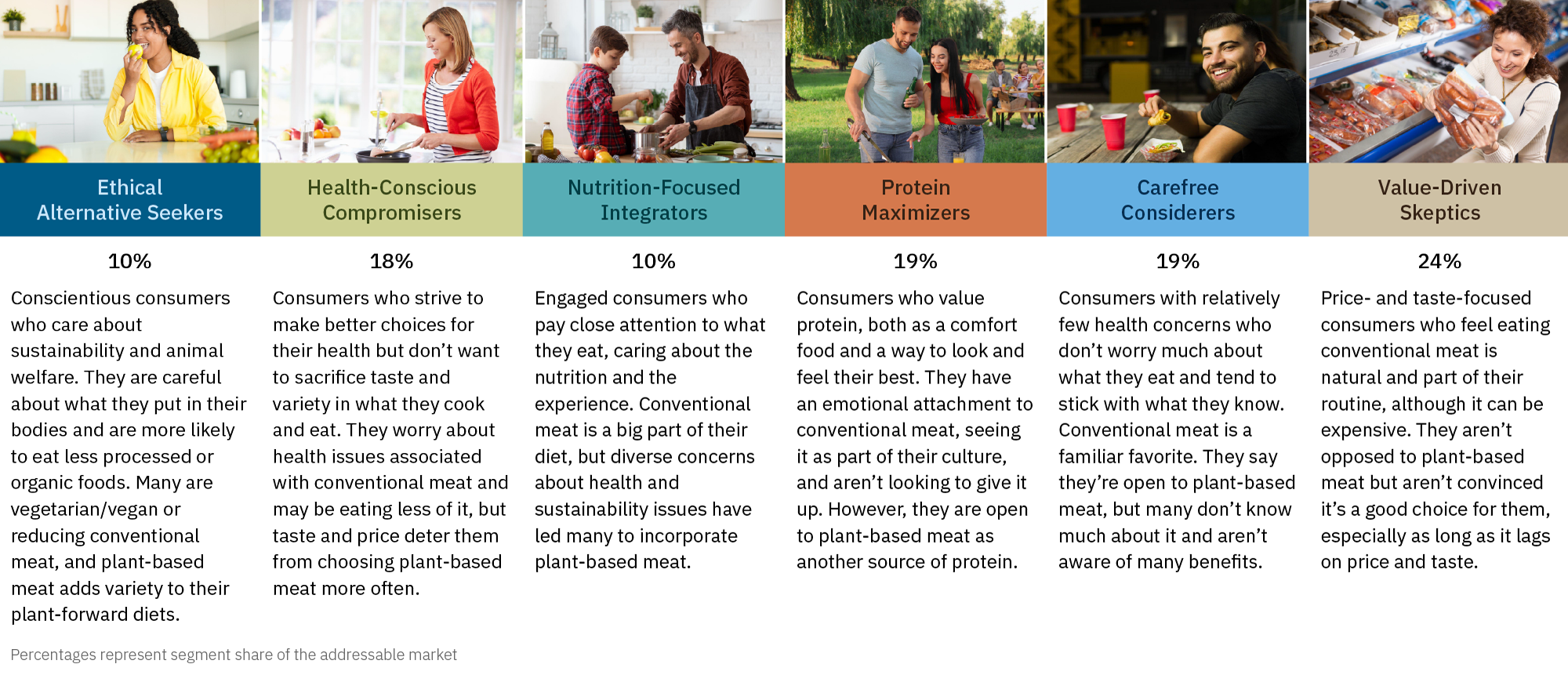

- Within the addressable market, six unique segments of consumers with distinct attitudes, needs, and motivations exist. These are largely not vegetarians or vegans, but omnivores who see various reasons to add plant-based meat to their diets.

- While taste and price expectations must be met for consumers across segments to consider plant-based meat, benefits around health, nutrition, and other attributes are important to motivate consumers to switch.

Meet the segments

Out of the six segments identified, four demonstrate higher engagement with plant-based meat and feel it delivers unique benefits that are important to them. These segments—Ethical Alternative Seekers, Health-Conscious Compromisers, Nutrition-Focused Integrators, and Protein Maximizers—appear to represent the best near-term opportunity to increase plant-based meat consumption. They are estimated to account for 57 percent of the addressable market but include over 80 percent of current plant-based meat eaters. Each segment is unique in the combination of needs that motivate those consumers and the differentiated benefits they feel plant-based meat delivers.

Explore the reports to understand how these drivers form the basis for the plant-based meat value proposition.

Download the reports

Explore the report summary, covering high-level overviews of each segment, and download the full report for in-depth data and analysis of segments’ household consumption patterns, preferred occasions and formats, and primary grocery channels.

Related resources

State of Alternative Protein series

Explore our comprehensive State of Alternative Proteins series for insights into the rapidly evolving alternative protein landscape.

U.S. household shopper insights for plant-based meat

Discover key insights on U.S. households buying plant-based meat. Explore data on demographics, purchase habits, motivations, barriers, and more.

Plant-based retail market overview

Explore sales data for plant-based meat, egg, and dairy products in the U.S. retail market. Find key category insights, size, sales growth, and purchase dynamics for the plant-based industry.