Plant-based meat: Anticipating 2030 production requirements

In recent years, consumer demand for plant-based meat has often outpaced the industry’s supply chain capabilities. This scenario-based analysis outlines expected ingredient volume and manufacturing facility needs for the plant-based meat industry to identify and mitigate future production bottlenecks.

Download the

white paper

The time for infrastructure investment is now

Based on publicly available forecasts of plant-based meat demand and production needs, this report explores a hypothetical production scenario: By 2030, plant-based meat has captured 6% of the global meat and seafood market, representing 25 million metric tons (MMT) of annual plant-based meat production.

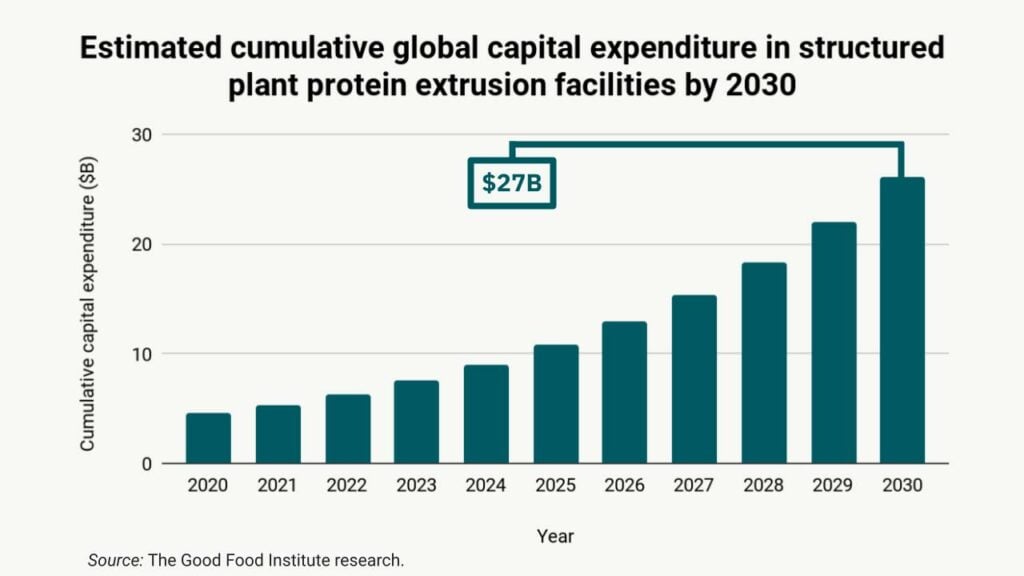

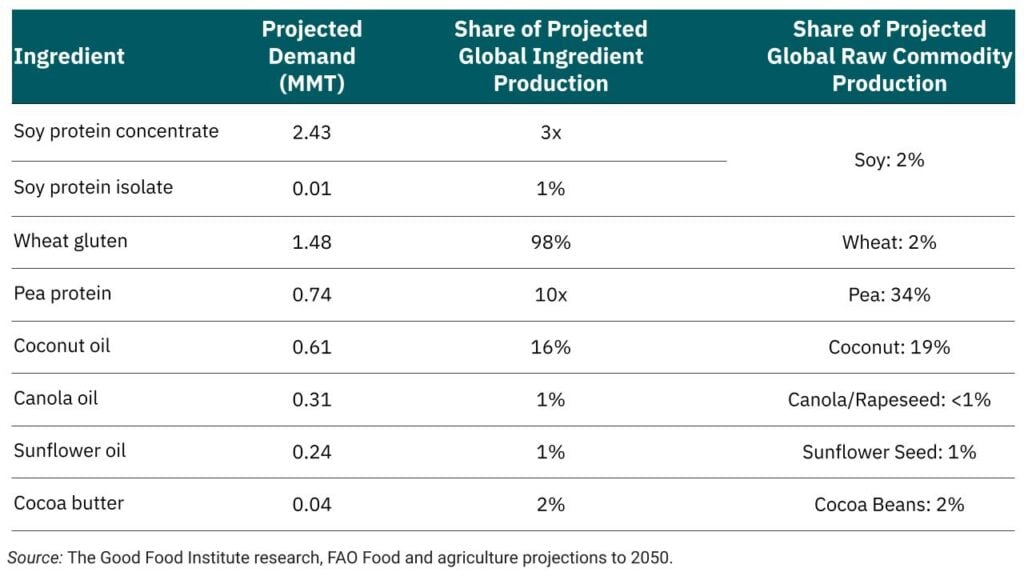

We identify a looming potential for global supply squeezes of cornerstone ingredients like coconut oil and pea protein and estimate that the industry will need to operate at least 800 manufacturing facilities—each producing on average 30,000 metric tons of product annually—at a cost of at least $27B within the decade, underscoring the importance and urgency of bold infrastructure investments.

The private sector—investors, ingredient processors, extrusion equipment providers, and manufacturers alike—can realize significant financial upside by building out this new supply chain. Likewise, global governments should recognize that meaningful climate gains from a scaled shift towards plant-based meat will not be achievable in the near term unless they invest soon in open-access R&D and infrastructure for this burgeoning industry.

WEBINAR

Anticipating 2030 production requirements for plant-based meat

This seminar addresses the potential for global supply squeezes of cornerstone ingredients like coconut oil and pea protein in the coming years. Early investment, innovative partnerships, and research for alternative ingredients or sourcing strategies that have the potential to mitigate future ingredient shortages are also discussed.

Download the report

The report “Plant-based meat: Anticipating 2030 production requirements” is a scenario-based exploration of the substantial ingredient supply chain needs, manufacturing facility requirements, and level of investment necessary to avoid future supply constraints and successfully meet a global plant-based meat production target of 25 MMT annually within the next decade.

Contents:

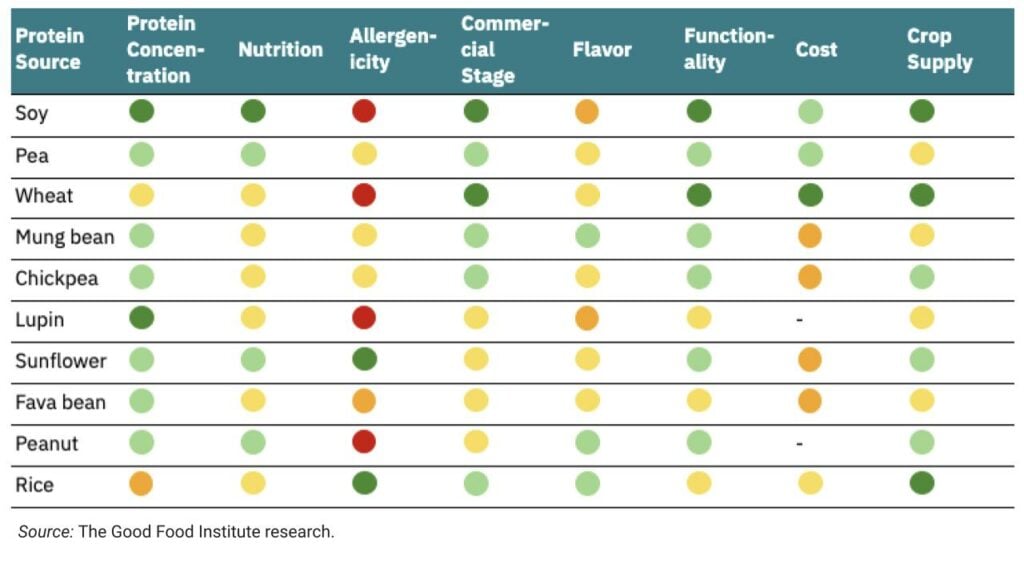

- FAO projections of global crop and ingredient production volumes for common plant-based meat ingredients.

- Forecasts of global crop and ingredient volumes necessary to satisfy the plant-based meat industry if demand growth continues.

- Review of two key manufacturing techniques for producing structured plant protein: low- and high-moisture extrusion.

- Estimation of the number of extrusion facilities necessary to satisfy 25 MMT of plant-based meat demand.

- Anticipated capital and operating expenditures required to construct and operate extrusion facilities.

- Recommendations to the industry for efficiently expanding industry-wide production capacity.

Page

The science of plant-based meat

Learn about the science of plant-based meat. Discover resources and research on the latest technological developments and key scientific questions.